What are the costs involved when buying a property in Dubai?

What are the costs involved when buying a property in Dubai?

Having a good knowledge of all the costs associated with buying a property is essential to make an informed decision to avoid last-minute unexpected expenses and arrange the finance well in advance.

There are in fact many costs associated with property buying in Dubai and it costs roughly to an amount of 5% to 10% of the total value of the property.

Government:

DLD Fee

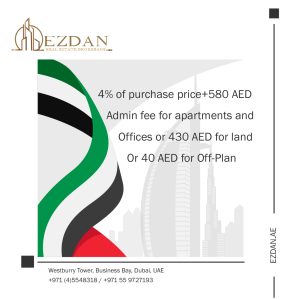

DLD stands for Dubai Land Department. The buyer has to pay a DLD Fee which is a 4% of property purchase price, plus a knowledge fee of AED 580 for apartments and offices, AED 430 for land and AED 40 for off-plan projects.

Now, you might have heard of DLD Waiver?

So DLD Waiver means that buyer need not pay this fee, the developer will pay instead.

Sometimes the developers offer 50% or 100% off on DLD fees, which means the buyer will have to pay the rest remaining fees if required.

One important thing to remember is that all the purchases must be registered with the DLD within 60 days of the transaction in Dubai. Otherwise, the transactions will be void.

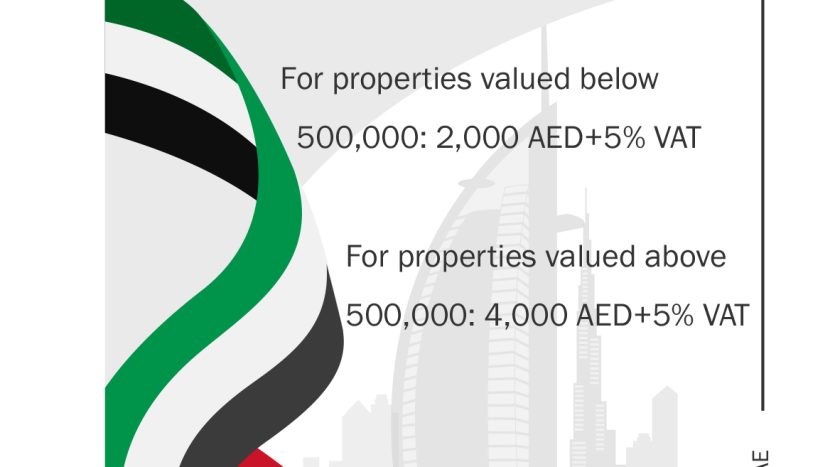

Property registration fee

A property registration fee should also be paid as follows:

In addition to this, a Registration Trustee Appointment fee must be paid in cash and costs AED 4,000 through title deed and 5,000 through off-plan.

A No Objection Certificate fee should also be paid to the Developers in Dubai ranging from 500 AED to 5000 AED. A 10% of the purchase price should also be paid as a cash guarantee deposit to the property developers.

Additional Fees involved in buying off-plan projects in Dubai

Apart from the DLD Registration fees, the buyer will have to pay 5250 AED for issuing the Oqood Certificate. It is obtained after paying 25% of the property price. Oqood Certificate ensures that the property is registered under the buyer’s name.

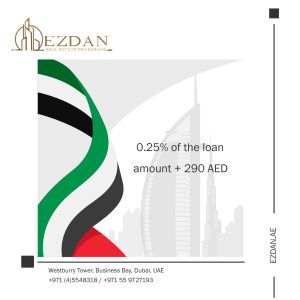

Mortgage Registration Fee

If you are taking a bank loan to purchase the property, you have to pay a fee to register the mortgage against the property which is as shown below.

Broker Agency Fees

If you seek the help of a Broker agency to find your perfect home, then you will have to pay an agency fee of 2% of the total price + VAT. This fee varies for different brokers as per the agreement between the buyer and the seller.

DEWA Fees

If the properties are newly transferred, then you have to pay a refundable deposit (2000 AED for Apartment & office or 4000 AED for villa) and a 100 AED reconnection charge.

Similarly, there will be charges for the EMPOWER Cooling Services if there is one in place such as a security deposit, admin fee, and quarterly demand charges in advance.